Contents:

- Preamble

- The Key Issue – Existential Risk

- The Rapidly Changing Context of Global Climate Change

- Practical Implications

- The Australian Context

- Existential Risk Management

- Request to Expert Panel

Preamble

Thank you for the opportunity to comment on the Preliminary Report into the Future Security of the National Energy Market. I congratulate the Expert Panel on a comprehensive analysis of the challenges faced by our ageing electricity grid system, the need for extensive reform to address the realities of 21st Century energy supply and the technological and market options available.

However I suggest that there is an overarching issue which the Preliminary Report does not adequately address, and that is the urgency with which we must address climate change, which in turn defines the context in which reform of the NEM should take place.

Time is of the essence. It seems unlikely, given the lack of action to date and the accelerating pace of climate change, that global average surface temperatures can now be held below the 1.5oC to 2oC range adopted in the 2015 Paris Climate Change Agreement which Australia has ratified. If the world seriously intends to address climate change, then far more urgent action is required than we are seeing thus far, particularly from Australia who is a notable laggard in its emission reduction commitments.

In reality, it demands emergency action, akin to placing economies on a war-footing. We have left it too late to achieve a smooth transition to a lower-carbon economy. Reform of the NEM has a critical role to play in this process, but it must be set against realistic emission reduction objectives far more stringent than the Government’s current emission reduction targets.

The rationale for this view is set out below:

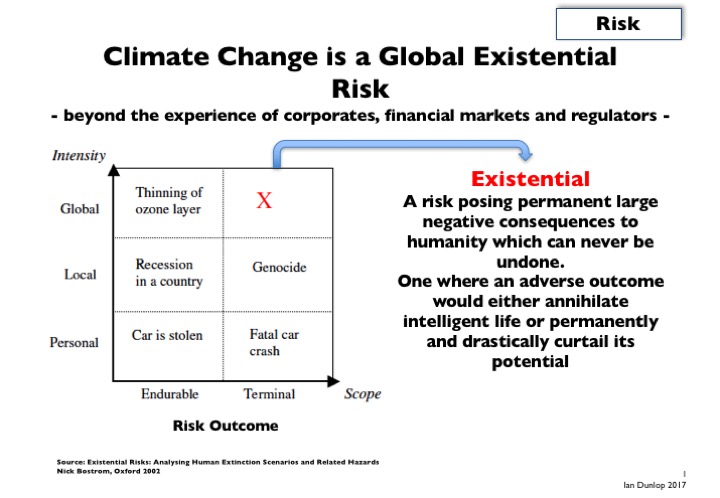

The Key Issue – Existential Risk

The Preliminary Report does not recognise that climate risk is an existential risk beyond the conventional risk management experience of corporates, investors, financial markets and regulators. It is an unprecedented challenge to humanity.

As such it requires fundamentally different risk, and opportunity, management from conventional practice. In turn this should be the over-riding consideration determining the extent and speed of reforming the NEM.

The Rapidly Changing Context of Global Climate Change

Any balanced assessment of the climate science and evidence accepts that climate change is driven primarily by human carbon emissions from fossil fuel combustion, agriculture and land clearing, superimposed on natural climate variability, and that it is happening faster and more extensively than previously anticipated.

In this context, scientists have long been concerned about the extreme “tipping point” risks of the climate system; non-linear positive feedbacks which trigger rapid, irreversible and catastrophic change.

These feedbacks are now kicking in. For example, Arctic weather conditions are becoming increasingly unstable as jetstream fluctuations warm the region 200C or more above normal levels; sea ice is at an all-time low with increasing evidence of methane emissions from melting permafrost [1]. Greenland and Antarctic ice sheets are melting at worst-case rates [2], with the potential for several metre sea level rise this century [3]. The Antarctic Larsen ice sheet and Pine Island glacier are showing signs of major breakup as a result of warming Southern Ocean waters, a process which is probably now irreversible [4] [5]. Coral reefs around the world, not least the Australian Great Barrier Reef, are dying off as a result of record high sea temperatures [6]. Global temperature increases are accelerating, with 2016 being the hottest year on record [7] [8]. Major terrestrial carbon sinks are showing signs of becoming carbon emitters [9]. And much more.

The social disruption and economic consequences are already devastating, leading to extensive forced migration and economic collapse in some countries. The refugee crisis engulfing Europe, emanating from Syria and North Africa, is fundamentally climate change driven [10] and a precursor of greater conflict ahead. The viability of the Middle East in toto is questionable in the circumstances now developing [11] [12]. Major centres of economic activity, such as the Pearl River Delta, responsible for 40% of China’s exports, the Mekong River Delta and other parts of SE Asia are now under threat from climate-induced sea level rise prior to 2050 [13]. This has major implications for Australia’s future.

Practical Implications

The Paris Agreement, the successor to the Kyoto Protocol, came into force on 4th November 2016. It requires the 195 countries participating to hold global average temperature to “well below 20C above pre-industrial levels and to pursue efforts to limit the increase to 1.50C” [14]. Regional temperature variations would be far greater than these global averages, rendering many parts of the world uninhabitable even at 20C, beyond the capacity of human physiology to function effectively.

Without rapid carbon emission reductions far greater than Paris commitments, the planet will become ungovernable. Dangerous climate change, which the Paris Agreement and its forerunners seek to avoid, is happening at the 1.20C increase already experienced as extreme weather events, and their economic costs, escalate. The negative impact on human health is already substantial [15] [16].

It is probably impossible to stay below the 1.50C Paris aspiration. To have a realistic chance, say 90%, of staying below even 20C, means that no new fossil fuel projects can be built globally, that existing operations, particularly coal, have to be rapidly replaced with low carbon alternatives, and that carbon sequestration technologies which do not currently exist have to be rapidly deployed at scale [17] [18].

Most dangerously, the climate impact of investments made today do not manifest themselves for decades to come. If we wait for catastrophe to happen, as we are doing, it will be too late to act. However governments, business and investors are complacently allowing the continuation of such investment on the basis that the 20C limit is some way off, with a substantial carbon budget still remaining. Neither proposition is correct and the existential risk implications are being ignored. Indeed, in circumstances of high uncertainty, which is the case currently with tipping points, even greater precautions should be taken than might be the case with better scientific knowledge.

The transition to a low-carbon economy is unprecedented. We have the technology, the expertise and wealth to make it happen. What we lack is the maturity to set aside political ideologies and corporate vested interests to cooperate in the public interest.

And most importantly, time. Any realistic chance of avoiding catastrophic outcomes, requires emergency action to force the pace of change, starting with a serious price on carbon to remove the massive subsidy propping up fossil fuels. The irony is that this transition is the greatest investment opportunity the world has ever seen.

These views are not irrational alarmism. They may be regarded as extreme relative to mainstream debate within the corporate, financial and investment communities. However they are well-grounded in the science and evidence, as set out in more depth in the “Climate Reality Check” paper referenced [19] and in the increasingly outspoken views of leading scientists [20].

The Australian Context

The Prime Minister’s National Press Club speech on 1st February 2017 [21] emphasised the need for “affordable, reliable and secure energy”, denounced the States for their “unrealistic” renewable targets, encouraged energy storage, but then placed the emphasis back on coal. Priority would be given to “clean coal and carbon capture and storage (CCS) and onshore gas (CSG)”, implying that renewables were neither affordable or reliable. Further “The next incarnation of our energy policy should be technology agnostic – it’s security and cost that matter, not how you deliver it. Policy should be ‘all of the above technologies’ working together to meet the trifecta of secure and affordable power while meeting our substantial emission reduction commitments”.

This approach ignores numerous inconvenient realities.

First, the speech skirted around our biggest risk, namely accelerating climate change. Whilst Australia ratified the Paris Climate Agreement, our emission reduction commitments are not “substantial”. They are laughable both in comparison with our peers globally, and to have any chance of making a fair contribution to the Paris objectives of holding global temperatures “well below 2oC above pre-industrial conditions and to pursue efforts to limit the increase to 1.5oC”.

Second, to have a realistic chance, say 90%, of meeting the Paris objectives, the world should no longer emit any carbon to atmosphere. We still emit record amounts today and need some fossil fuels to build the new low-carbon economy, so that is not going to happen. But emissions must peak and decline rapidly. There is no space for any new fossil fuel projects, coal, oil or gas.

Third, “clean coal” is neither new nor clean. These technologies can reduce emissions by up to 40% relative to conventional practice, but that does not solve our problem when the global carbon budget has already been exhausted. Further, costs are increased by up to 30%, rendering coal even less competitive with renewables.

Fourth, years of research have failed to establish the basis for CCS expansion at scale. CCS works where emissions are stored in depleted oil and gas reservoirs, which the oil industry has practised for decades. Storage in other types of geological structures is far harder. The few commercial operations in the world today are in the former category. The substantial additional costs of CCS again reduce coal’s competitiveness, particularly if you refuse to price carbon, as the government are doing. CCS will be useful at the margin, but it will not save fossil fuels from their inevitable demise.

Fifth, energy prices rose largely because our flawed regulatory framework allowed power companies to invest in unnecessary infrastructure on which they were guaranteed a return. Gas prices rose because the East Coast was opened up to the higher priced international gas market with the construction of export facilities at Gladstone. The unseemly rush into CSG resulted in substantial processing overcapacity, with economic pressure increasing as CSG production was constrained by community objection to the damage caused to arable land and water. Further, high methane leakage rates result in CSG having a greater warming effect than using coal, thereby negating its supposed benefit.

Sixth, there is nothing “agnostic” about choosing energy sources when the fossil fuel industry continues to enjoy a massive subsidy, far greater than renewables, by the lack of carbon pricing. A subsidy the IMF estimate to be around 60% of coal’s market price [22]. And this is the nub of the problem. Our climate and energy policies are a disconnected and dysfunctional shambles, brought about by years of denial and inaction from Federal Governments of both persuasions who do not accept that climate change is happening.

But that game is up. Climate change has moved from the twilight phase of much talk and relatively limited impact. It is now turning nasty. Events are moving faster than expected as irreversible climate tipping points are crossed. The economic and social costs of inaction can no longer be swept under the carpet, with regulators here and overseas demanding action to head off a climate-induced financial crisis.

The only way we can avoid catastrophic climate impact now is to initiate emergency action, akin to a war-footing. That will be accepted before long as impacts bite and low carbon technology undermines the fossil fuel industry

Our antiquated electricity grids are undoubtedly in need of overhaul, but 100% renewable grids are being constructed around the world in only a few years, providing genuine energy security and making traditional concepts of base-load power irrelevant.

As for affordability, energy prices will rise given the extent and speed of change. It is irresponsible to suggest otherwise. However they will rise less with renewables than with coal, with greater prospects of cost reduction as technology improves.

We need a new narrative, built around our potential to prosper as a low-carbon society. We have the world’s best renewable resources, the science, the technology and engineering expertise to seize what is the biggest investment and job-creation opportunity this country has ever seen.

Existential Risk Management

Climate change is existential risk management on a global scale. The risk implications outlined above require that existential risk should now be the primary consideration in managing climate change and NEM reform. It should be built around existential risk management policy unlike anything being contemplated officially at present. The components would encompass:

- Normative Goal Setting. “Politically realistic”, incremental change from “business-as-usual” is not tenable. This must be replaced with a normative view of limits which must be adhered to if catastrophic consequences are to be avoided, based on the latest science. Action is then determined by the imperative to stay within the limits, not by incremental, art-of-the-possible, change from business-as-usual.

- Change Mindsets, to now regard the climate change challenge as a genuine global emergency, to be addressed with an emergency global response.

- Genuine Global Leadership. Current responses reflect the dominance of managerialism – an emphasis on optimising the conventional political and corporate paradigms by incremental change, rather than adopting the fundamentally different normative leadership needed to contend with the potential for catastrophic failure.

- Integrated Policy. Climate change, though difficult, is only one of a number of critical, inter-related, issues now confronting the global community, which threaten the sustainability of humanity as we know it. Rather than viewing these issues separately in individual “silos” as at present, integrated policy is essential if realistic solutions are to be implemented. NEM reform needs to fit within a systemic Australian approach to emergency action.

- There needs to be an honest articulation of the catastrophic risks and the integrated sustainability challenge we now face, with extensive community education to develop the platform for commitment to the major changes ahead. That has not happened thus far. Investors, corporates and regulators have a crucial role to play in articulating reality and in adopting constructive solutions.

Request to the Expert Panel

I request the Expert Panel, in developing their final recommendations for NEM reform, to recognise that:

- Climate change already poses an existential risk to global economic, financial and societal stability.

- To limit temperature increase within globally agreed objectives, emergency action is now inevitable.

- Emission reduction objectives for the Australian electricity system should be recast accordingly.

- The Final Report needs to incorporate the need for emergency action in NEM reform, with market arrangements and technological choices structured accordingly, including carbon pricing.

- Existential risk management techniques are required which fundamentally differ from conventional practice.

Ian T Dunlop

Sydney, Australia

————-

Author:

Ian Dunlop

Ian Dunlop has wide experience in energy resources, infrastructure, and international business, for many years on the international staff of Royal Dutch Shell. He has worked at senior level in oil, gas and coal exploration and production, in scenario and long-term energy planning, competition reform and privatization.

He chaired the Australian Coal Associations in 1987-88. From 1998-2000 he chaired the Australian Greenhouse Office Experts Group on Emissions Trading which developed the first emissions trading system design for Australia. From 1997 to 2001 he was CEO of the Australian Institute of Company Directors. Ian has a particular interest in the interaction of corporate governance, corporate responsibility and sustainability.

An engineer from the University of Cambridge (UK), MA Mechanical Sciences, he is a Fellow of the Australian Institute of Company Directors, the Australasian Institute of Mining and Metallurgy and the Energy Institute (UK), and a Member of the Society of Petroleum Engineers of AIME (USA).

Ian is a member of the Board of the ARC Centre of Excellence for Climate System Science based at UNSW.

He is a Director of Australia 21, Deputy Convenor of the Australian Association for the Study of Peak Oil, a Fellow of the Centre for Policy Development, a Member of The Club of Rome and a member of Mikhail Gorbachev’s Climate Change Task Force. He advises and writes extensively on governance, climate change, energy and sustainability. He was a candidate in 2013 and 2014 to join the Board of BHP Billiton on a climate change and energy platform.

Reference

[1] https://nsidc.org/arcticseaicenews/2016/12/arctic-and-antarctic-at-record-low-levels/

[2] http://www.smh.com.au/environment/sealevel-expert-john-church-resurfaces-at-university-of-nsw-amid-new-warning-signs-from-greenland-20161207-gt5qje.html

[3] https://www.theguardian.com/science/2016/mar/22/sea-level-rise-james-hansen-climate-change-scientist

[4] Antarctic tipping points for a multi-metre sea level rise, David Spratt, February 2017:

http://www.breakthroughonline.org.au/papers

[5] http://mashable.com/2016/12/03/nasa-photo-crack-larsen-c-ice-shelf/#GlKFT3rWbmqE

[6] https://www.theguardian.com/environment/2016/dec/09/great-barrier-reef-not-likely-to-survive-if-warming-trend-continues-says-report?utm_source=esp&utm_medium=Email&utm_campaign=GU+Today+AUS+v1+-+AUS+morning+mail+callout&utm_term=203508&subid=13317484&CMP=ema_632

[7] 2016 Warmest Year on Record Globally, NASA/NOAA, January 2017:

https://www.nasa.gov/press-release/nasa-noaa-data-show-2016-warmest-year-on-record-globally

[8] Global Heat Record Broken Again, Climate Council, January 2017:

https://www.climatecouncil.org.au/2016-hottest-year-report

[9] https://www.washingtonpost.com/news/energy-environment/wp/2016/11/30/the-ground-beneath-our-feet-is-poised-to-make-global-warming-much-worse-scientists-find/?utm_term=.2b40ab750c08

[10] http://www.pnas.org/content/112/11/3241.full

[11] The Roasting of the Middle East – Infertile Crescent, The Economist, 6th August 2016

[12] Extreme Heatwaves could push gulf climate beyond human endurance, The Guardian 26th October 2015:

[13] How climate change will sink China’s manufacturing heartland, David Spratt & Shane White, 10th August 2016:

http://www.climatecodered.org/2016/08/how-climate-change-will-sink-chinas.html

[14] UNFCCC Paris Agreement Article 2:

https://unfccc.int/resource/docs/2015/cop21/eng/l09r01.pdf

[15] The Lancet Commission:

http://www.thelancet.com/pdfs/journals/lancet/PIIS0140-6736(16)32124-9.pdf

[16] Australian Academy of Science, Climate Change Challenges to Health:

https://www.science.org.au/supporting-science/science-sector-analysis/reports-and-publications/climate-change-challenges-health

[17] “Climate Reality Check”, David Spratt & Ian Dunlop, Breakthrough Institute, Melbourne, June 2016:

http://www.breakthroughonline.org.au/papers

[18] The Sky’s Limit, Oil Change International, September 2016:

http://priceofoil.org/content/uploads/2016/09/OCI_the_skys_limit_2016_FINAL_2.pdf

[19]ibid “Climate Reality Check”, David Spratt & Ian Dunlop, Breakthrough Institute, Melbourne, June 2016:

[20] “The World’s Biggest Gamble”, Johan Rockstrom, Hans Joachim Schellnhuber et al, AGU October 2016:

http://onlinelibrary.wiley.com/doi/10.1002/2016EF000392/abstract

[21] https://www.pm.gov.au/media/2017-02-01/address-national-press-club

[22] Getting Energy Prices Right, International Monetary Fund, July 2014:

https://www.imf.org/external/pubs/cat/longres.aspx?sk=41345.0